Current Location:Home > NEWS > Industry news

NEWS

Oil prices and falling stock market led to market risk aversion 12 tin co., LTD

類别:Industry news 發布時間:2018-11-12 15:37:39 浏覽:1015 次

Abstract: oil prices and the stock market down the market risk aversion, weaker every Zhou Lunxi fell to $180; Last week at home and abroad have different inventory increase or decrease, domestic tin the nearly 20 weeks high inventory, demand is weak or suppress prices upward.

Futures market: oil prices and the stock market down cause market risk aversion rising, every Zhou Lunxi weak consolidation, late fall, the latest closing price to $fell from $19110 to $180, or 0.93%, volume 27 390 hand cut hand, holdings of 16409 an increase of 536 hands. Tin mixed Friday night Shanghai, main 1901 contract latest closing price to increase by 430 yuan to 149150 yuan, up 0.29%.

London metal exchange (LME) 9, tin the latest inventory of 2920 metric tons, inventory reduction than the previous trading day of 150 metric tons; Aaron tin falling inventories last week, weekly inventory has fallen 235 metric tons, a 7.45% decline; Shanghai tin weeks inventories last week 128 tons to 8027 tons, growth of 1.62%, its highest level since nearly two weeks.

On November 9, - the week of domestic spot tin prices higher, 1 # tin spot weeks average price 146150 yuan/ton, daily average rose 600 yuan/ton, the weekly is up 2.07%. Today Shanghai tin opened higher, 1901 contract main month opening price rose to 149490 yuan, 770, 9:10 main Shanghai tin rose to 148980 yuan, 260; Last week at home and abroad have different inventory increase or decrease, domestic tin the nearly 20 weeks high inventory, demand is weak or suppress prices upward, tin today Shanghai consolidation is given priority to, is expected to spot tin co., LTD.

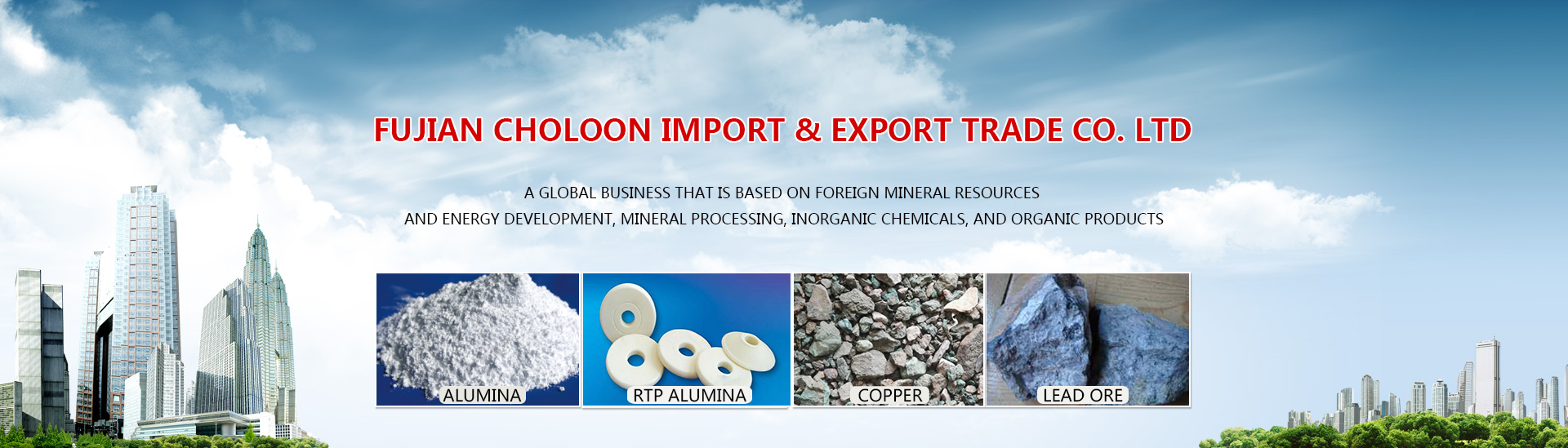

Fujian and lung import and export trade co., LTD

Futures market: oil prices and the stock market down cause market risk aversion rising, every Zhou Lunxi weak consolidation, late fall, the latest closing price to $fell from $19110 to $180, or 0.93%, volume 27 390 hand cut hand, holdings of 16409 an increase of 536 hands. Tin mixed Friday night Shanghai, main 1901 contract latest closing price to increase by 430 yuan to 149150 yuan, up 0.29%.

London metal exchange (LME) 9, tin the latest inventory of 2920 metric tons, inventory reduction than the previous trading day of 150 metric tons; Aaron tin falling inventories last week, weekly inventory has fallen 235 metric tons, a 7.45% decline; Shanghai tin weeks inventories last week 128 tons to 8027 tons, growth of 1.62%, its highest level since nearly two weeks.

On November 9, - the week of domestic spot tin prices higher, 1 # tin spot weeks average price 146150 yuan/ton, daily average rose 600 yuan/ton, the weekly is up 2.07%. Today Shanghai tin opened higher, 1901 contract main month opening price rose to 149490 yuan, 770, 9:10 main Shanghai tin rose to 148980 yuan, 260; Last week at home and abroad have different inventory increase or decrease, domestic tin the nearly 20 weeks high inventory, demand is weak or suppress prices upward, tin today Shanghai consolidation is given priority to, is expected to spot tin co., LTD.

Fujian and lung import and export trade co., LTD